Category: Digital Edge

-

Pyramid Schemes Are More Lucrative Than You Think and Here’s Why

Image Source: 123rf.com In most countries, pyramid schemes are illegal, and for good reason. The practices of companies that operate a pyramid scheme are deceptive to consumers and their participants. According to Yahoo Finance, a pyramid scheme is “a form of fraud that involves promising participants payments or services, primarily for enrolling other people into…

-

Easy Food to Sell to Make Money

There are so many different ways to make a little bit of extra money. For example, you can sell food. Whether you sell it at farmers’ markets, from a food truck, going door to door, or through a small online business, selling food can be a great way to garner some new income. You want…

-

How Much Does Chick Fil A Make in A Day

If you’re unfamiliar, Chick-Fil-A is a popular fast food restaurant chain. The company not only serves delicious fried chicken and waffle fries, but also delivers exceptional service. Its commitment to customer care has helped draw in patrons who want a pleasant experience along with a tasty meal. In business, the level of acclaim Chick-Fil-A has…

-

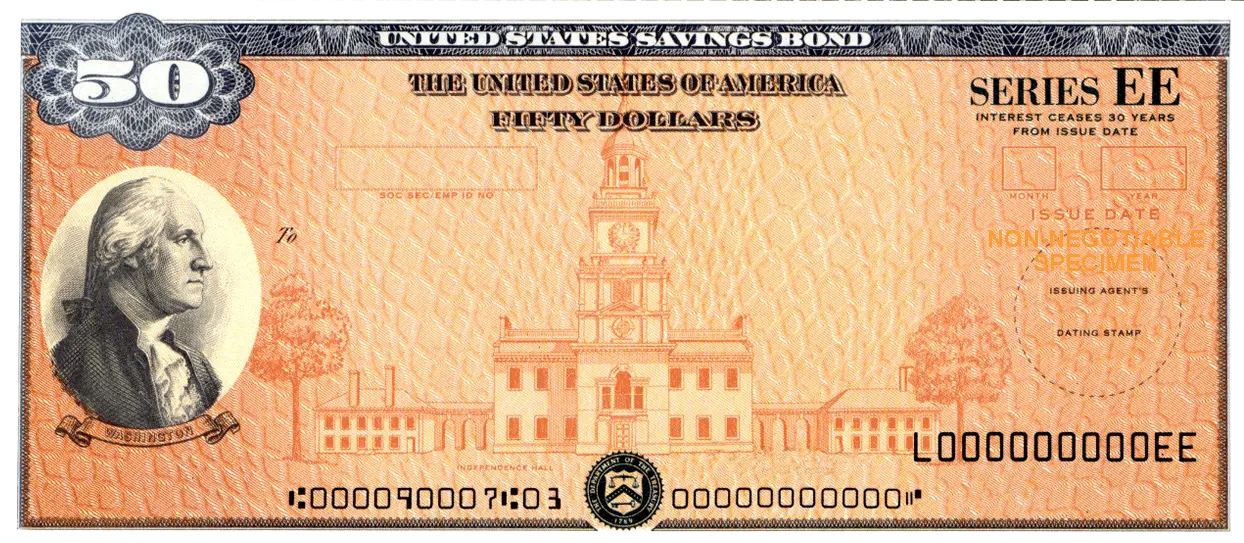

The Best Place to Put Savings From A Side Hustle – Savings Bonds

George Washington $50 U.S Savings Bond, Image source: Treasury.gov. It’s a hard time to look for work in America, and many Americans are looking. Over 45% of Americans earn extra money by working a side hustle. Most of the Americans who do work a side hustle work an extra 12-hours on top of their primary…

-

How Many Quarters Make A Dollar?

United States quarter dollar coin showing the first president of the US, George Washington. This article is for everyone unfamiliar with the United States quarter dollar. Whether you’re just learning about money in school or are visiting the U.S. from overseas, you may have some questions about the quarter. The US quarter was first authorized…

-

Snowflaking: 30 Ways to Snowflake Your Debt Away

Most people that have decided to take control of their finances and reduce their debt have come across at least one of the various debt snowball methods. Basically, creating a debt snowball is a way to arrange one’s debt so as to tackle a single debt at a time (to more efficiently pay off the…

-

Zombie Debt Explained (What It Is And How To Kill It For Good)

Zombie debt is old, uncollectible debt that collectors resurrect to pressure you into paying, even when you don’t legally owe it. What is Zombie Debt (and Why Won’t it Die?) Just when you thought your financial life was in order, a debt collector calls about something you paid off years ago—or worse, a debt you…

-

Guaranteed Interest Accounts (What Is It And Who Needs One)

A Guaranteed Interest Account (GIA) is essentially an insurance contract that pays a fixed, guaranteed interest rate for a specific period. GIAs promise stability, but are they actually a smart move for you? What the Hell Is a Guaranteed Interest Account (GIA) Anyway? A Guaranteed Interest Account is a financial product offered by insurance companies…

-

Top 3 Money Regrets (+Prevention Strategies)

Ever made a big, impulsive purchase only to feel instant regret, guilt, and an uneasy knot in your stomach? You’ve probably experienced buyer’s remorse. In this guide, we’ll uncover three major purchases that often lead to buyer’s remorse, explore why this happens, and provide strategies for making smarter purchasing decisions moving forward. What Is Buyer’s…

-

Episode 205. “I’ve been homeless before…I’m terrified to spend money”

Jennifer (37) and Steve (41) have been dating for over five years, but they’ve never spent more than $100 on a shared purchase. Jennifer is a self-made business owner with a clear vision for the future, while Steve is cautious, financially conservative, and still haunted by a turbulent past that included losing both parents…

-

Episode 202. “She racked up $50K in debt — why should I trust her with money?”

Emma (39) and Dave (39) make $258,000 a year—but they’re stuck in a toxic money dynamic. She built a financial plan during maternity leave. He didn’t believe her. Now, they’re battling over trust, $50K in debt, and whether they can afford a $700K house. With conflicting money roles—she’s the anxious planner, he’s the passive skeptic—they…

-

Episode 206. “I quit my job to care for our son, but can we afford it?”

Anna (33) and Will (37) are married with two kids, including a young son who was born with a serious heart condition. Between unexpected medical expenses, emotional stress, and inconsistent financial planning, their savings have steadily drained—and now, they’re spending more than they earn just to keep up. Will brushes off concerns, saying “We’re…

-

Zero Budget, Big Dreams: How I Made $300 with CPA Marketing in College

As a college student, I was suffocating under the weight of endless assignments, skyrocketing expenses, and a bank account that mocked my dreams. But then I discovered Cost Per Action (CPA) marketing—a electrifying side hustle that transformed my desperation into triumph, earning me $300 in just one month with zero upfront investment. CPA marketing isn’t…